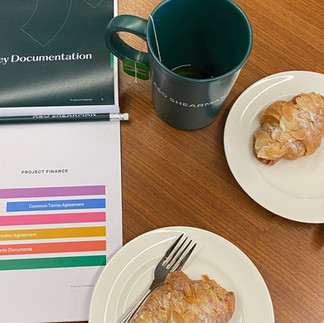

Introduction to Banking and Finance by A&O Shearman

- ALSA Thailand

- Nov 2, 2024

- 2 min read

Updated: Jan 18, 2025

In today's dynamic global economy, understanding the complexities of banking and financial law is essential for future legal professionals. The "Introduction to Banking and Financial Law by A&O Shearman" provides an invaluable opportunity for students to equip participants with a comprehensive overview of finance and banking. The lecture session focused mainly on Thailand’s landscape of banking and financial law, overview of an end-to-end project timeline including the types and nature of the transactions involved, and examples of previous case studies, followed by a Q&A session.

Exploring the Landscape of Banking and Finance in Thailand

The banking and finance sector in Thailand plays a pivotal role in driving the country’s economic development. Characterized by a robust legal framework and diverse financial services, it stands as a dynamic and integral part of the nation’s economy. Understanding this landscape involves not only grasping the key players and market trends but also recognizing the contributions of international law firms like A&O Shearman in shaping the sector.

Overview of Banking and Finance in Thailand

Thailand’s banking sector operates under a dual framework of local regulations and international standards, ensuring stability and alignment with global best practices. This framework supports a variety of financial institutions, including commercial banks, investment banks, and specialized financial companies, all of which contribute to economic

growth through lending, investment, and financial advisory services.

Key Players in the Market

Among the prominent international law firms, A&O Shearman stands out for its expertise in banking and finance. With a strong presence across the Asia-Pacific region, the firm offers comprehensive legal services that address various financial transactions, including:

Mergers & Acquisitions (M&A): Advising clients on regulatory compliance and strategic planning for significant transactions.

Project Finance: Facilitating financing for infrastructure developments, energy projects, and other large-scale ventures.

Corporate Finance: Structuring debt instruments and equity offerings to support corporate growth.

Recent Trends and Developments

The Thai banking and finance sector continues to evolve, reflecting global shifts and local innovations:

Digital Transformation: Traditional banks are adopting fintech solutions to enhance customer experiences and streamline operations.

Sustainable Financing: There is a growing emphasis on green loans and environmentally friendly initiatives to support sustainability.

Cross-Border Transactions: Globalization has increased the demand for expertise in cross-border financing arrangements, further integrating Thailand into the global financial system.

Conclusion

As Thailand’s banking and finance sector continues to grow and adapt to emerging trends, it offers significant opportunities for stakeholders. With the expertise of firms like A&O Shearman, businesses and financial institutions can navigate this complex landscape with confidence.

The rise of digital innovation and sustainable finance, coupled with a strong regulatory framework, signals a promising future for the sector. Legal professionals will remain central to this growth, facilitating transactions, ensuring compliance, and promoting integrity and sustainability in financial operations.

Comments